My account

European Health & Fitness Market Report 2019 - EBOOK

Other insights:

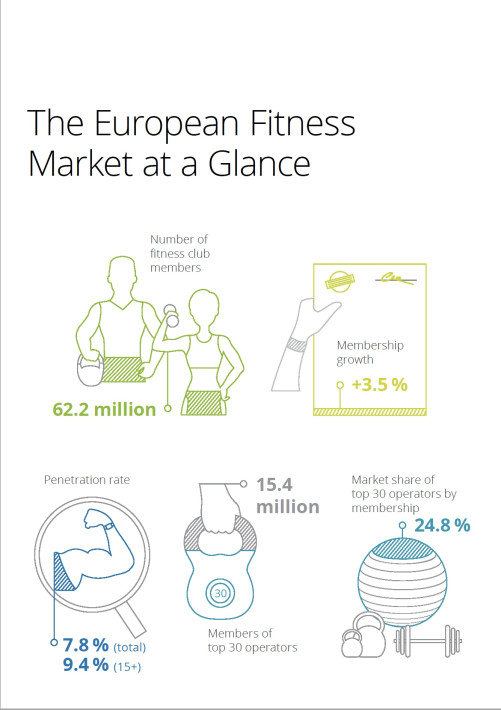

European health and fitness club memberships grew by 3.5% to 62.2 million in 2018, strengthening fitness as the #1 sports activity in Europe Total fitness club revenues were €27.2 billion (+3.4% at constant currency).The number of facilities increased by 4.6% to 61,984.

Consolidation continues; the top 30 European fitness club operators accounted for 15.4 million members (+11.2%), representing 24.8% of all membership Merger and acquisition activity reached a new high in 2018 with 24 major M&A transactions in the operator market identified for this report.

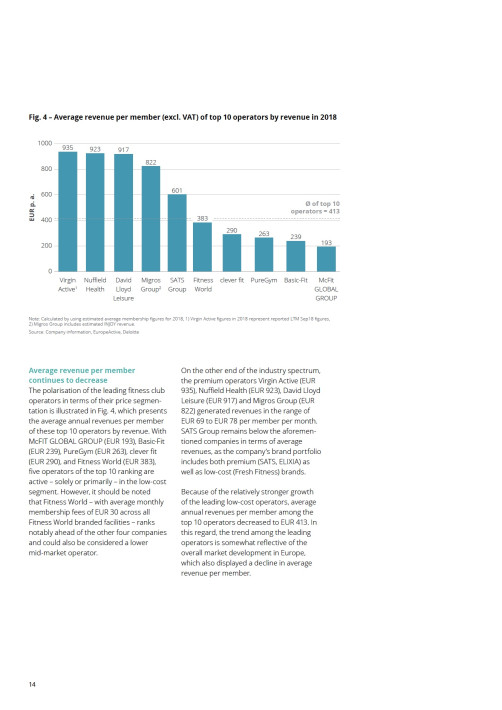

Top 3 OperatorsIn terms of revenues, the UK-based premium operator David Lloyd Leisure (EUR 545 million), low-cost operator Basic-Fit (EUR 402 million) and the Swiss operator Migros Group (EUR 383 million) led the European operator rank. Herman Rutgers, EuropeActive Board member and co-author of the report, commented: “2018 was another year of continued growth for the sector. It was interesting to see positive developments across all market segments; value, premium as well as some mid-market operators.

Additionally, we saw more small and medium-sized facilities opening closer to where people live and work, making fitness even more accessible for all. We remain confident to reach the industry goal of 80 million members by 2025.”This report was made possible by the generous support of Basic-Fit, Exerp, FIBO, Gympass, IHRSA, Technogym and YANGA Sports Water.